In this article, you will get introduced into everything you need to know about the housing bubble through 5 main axes

- What is the housing bubble?

- Why housing bubble occur?

- Where are the largest markets affected by the housing bubble?

- How to overcome the housing crisis?

- What is coming next regarding the bubble?

What is the housing bubble?

A housing bubble is simply a situation of very high housing process according to high purchase demand compared with one’s annual income. The optimum ratio would be that a property price equal to or less than 3 times the mentioned income. This bubble occurs in most of the big markets where it always starts by a high demand facing a limited supply of units. Afterwards, real estate market shareholders start to pour extra fund to market to fill this gap. However, at some point the demand stop, because of the high prices. And the supply increase trying to fill the illusionary gap resulting in bubble bursting. That’s when the market watches a significant drop in property prices, going back to their original values.

Why housing bubble occur?

First, one should know that a bubble can happen in any sector of trading. It’s a real risk problem in the relation between supply and demand. It can be caused according to human factors like wars, political decisions or natural disasters as flooding, fires, etc. Any of these factors can decrease the supply rate forming a bubble. However, in absence of these factors a bubble can be created as a result of ununiformed kind between supply and demand. For example, if the direction of the government is to build more of fancy villas and gated communities in the same time community need a kind of affordable housing this will result in the bubble as well. To clarify and explain more what would result in this bubble next are the main non-natural reasons for demand increase:

- Sudden increase in population or their demographics according to emigrations or other reasons.

- Non-fair mortgage system that results in maximum profit for investors while overwhelming residents with high rents and taxes.

- Pivotal economic activities of suppling more money in the housing sectors and encouraging individuals on replacing rents with homeownership

- Low-interest level that encourages home owning

- High purchasing activities from some buyers as a result of vague, unrealistic future predictions.

One of these factors or all of them combined can cause a series bubble in the market. However, markets respond differently to the same factors. Find next what are the biggest markets affected by the housing bubble.

Where are the largest markets affected by the housing bubble?

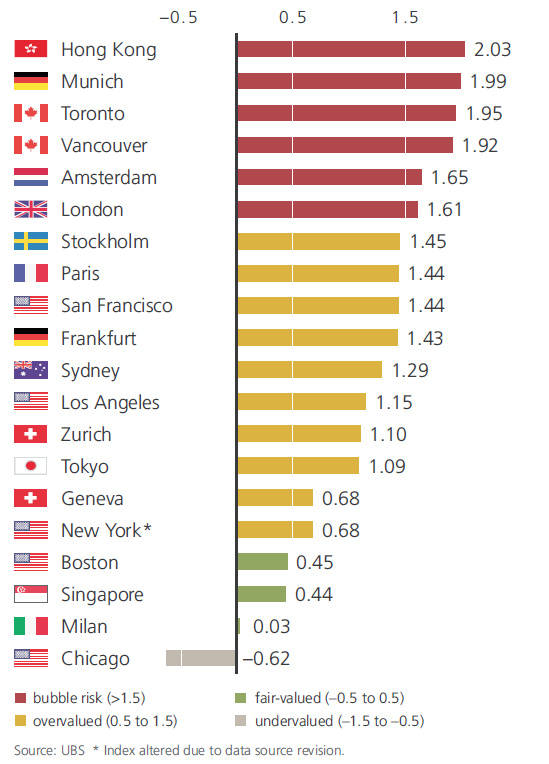

The year 2018 has witnessed a big global bubble that affected different markets like Hong Kong, London and some big United States market. According to Real Estate Bubble Index UBS, you need to work 22 years to afford a flat in Hong Kong, 15 years to afford one in London or Paris and around 10 years for getting one in New York. The following chart explains which cities are facing a bubble risk and for now there are 3 from Europe, 2 from Canada and 1 from Asia. Worth mentioning also that there are 4 cities that score just under the red indicator risk, respectively Stockholm, Paris, San Francesco and Frankfurt.

How to overcome the housing crisis?

A question like how we solve a big problem as a housing bubble is very big and broad to answer. However, we believe there is always a way to minimize the effects of such a housing crisis.

- Offering a safe load program for low-income residents that would not pull them to the abyss.

- Provide house consulting services that can guide each individual to the matching system with his income and needs.

- Prevent borrowers from entering the process to make a profit and putting more burden on people.

- Legislation of serious laws guaranteeing the right of residents to get a property without drowning them to jail.

- Activate unemployment programs because unemployment is one of the main reasons that refrain tenants and owners from paying and tackle the crisis.

Some of these factors can prevent a bigger crisis of price break down. Of course, no one wants a second 2008 in his life. That why we should watch and monitor closely the market performance so we can predict what would come next?

What is coming next regarding the bubble?

A research report that was done by Zillow pointed out that experts predict a big recession to take place in the U.S by 2020. Nearly half of the surveyed real estate firms predicted this recession to start in the first quarter of the year. The reason lies in the huge economic expansion which is considered the second longest one in American history that would soon bubble and burst. “Housing affordability is a critical issue in nearly every market across the country, and while much remains unknown about the precise path of the U.S. economy in the years ahead, another housing market crisis is unlikely to be a central protagonist in the next nationwide downturn.” Said Aaron Terrazas, senior economist at Zillow.

What we all know is that markets would never fix themselves. Countries at risk for a new housing bubble should be careful about any triggering factor. Housing is a crisis that impacts on almost every other industry. If a person can’t afford a safe space to live in, how should he live, interact and produce?