A concise, decision-ready comparison of four widely used construction-management platforms for small and mid-size U.S. general contractors. Use this guide to shortlist tools, estimate budget ranges, scope pilots, and prepare your RFP.

Contractors evaluating software in 2025 typically fall into three groups:

Small GCs (5–25 field staff) needing simple, mobile-first apps their crews will actually use.

Mid-size GCs looking for strong controls, integrations, and predictable pricing without the overhead of enterprise rollouts.

Value-focused buyers who want clear pricing expectations and fast time-to-value.

This guide evaluates four platforms—PlanRadar, Procore, Autodesk Build, and Fieldwire—against the needs most frequently raised by small and mid-size U.S. contractors, including:

-

Best overall options for smaller and mid-sized GCs

-

Which tools offer strong mobile apps for day-to-day site work

-

What typical pricing ranges look like for small teams

-

Which platforms deliver the fastest time-to-value and lowest admin overhead

-

How each tool performs on project controls, field execution, document/BIM workflows, integrations, and reporting

Ratings reflect hands-on evaluations and real GC use cases. Treat them as a guide for due diligence—not a replacement for a structured 6–8 week pilot on a live project.

1. Shortlist

📌 Evaluation Criteria (how we scored 1–10)

📌 Project Controls (25%) — RFIs, submittals, change events, contracts, budgets/cost.

📌 Field Execution (20%) — inspections, punch/issues, daily logs, offline mobile.

📌 Document Mgmt & BIM (20%) — drawing control/versioning, model viewing, markups.

📌 Integrations & Ecosystem (15%) — APIs, webhooks, partner apps, ERP/storage/SSO.

📌 Reporting & Analytics (10%) — dashboards, custom exports, BI connectivity/scheduling.

📌 Value for Money (10%) — licensing flexibility, time-to-value, admin overhead, storage fees.

Scoring reflects feature depth, ecosystem maturity, and GC fit. Use it to guide due diligence, not as a substitute for hands‑on pilots.

| Software | Best For | Price Range * | Implementation Effort | Key Differentiator |

| PlanRadar | Small–mid GCs standardizing QA/QC, punch & safety fast across many jobs | $$ | Low–Med | Ease of use, flexibility – adapts to your workflows; free subs. |

| Procore | Mid-size GCs planning to scale with enterprise-grade cost & contract controls | $$$$ | High | Largest construction app marketplace; strong cost & controls |

| Autodesk Build | Mid-size, Autodesk-centric teams wanting model-to-field continuity | $$$ | Med–High | Native link to Docs/Models; RFIs/Submittals + Cost |

| Fieldwire | Small–mid GCs needing lean jobsite tasking/punch with minimal admin | $$ | Low–Med | Quick rollout; streamlined field workflows |

*Relative, not list pricing. Use for early budgeting only.

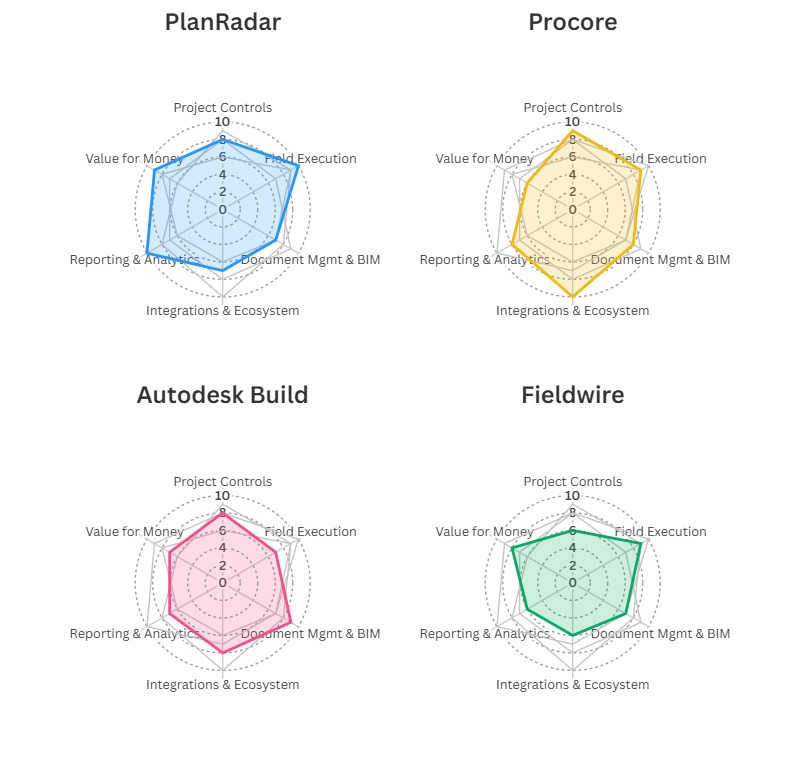

2. Performance Rating

| Software | Project Controls | Field Execution | Document Mgmt & BIM | Integrations & Ecosystem | Reporting & Analytics | Value for Money |

| PlanRadar | 8 | 10 | 7 | 7 | 10 | 9 |

| Procore | 9 | 9 | 8 | 10 | 8 | 6 |

| Autodesk Build | 8 | 7 | 9 | 8 | 7 | 7 |

| Fieldwire | 7 | 9 | 7 | 6 | 6 | 8 |

5 = acceptable, 8 = strong, 10 = best-in-class

3. Profiles

PlanRadar

PlanRadar is a leading platform for field management platform in construction, facility management and real estate projects. It enables customers to work more efficiently, enhance quality and achieve full project transparency. Best for small–mid GCs who want quick, repeatable workflows across many projects without heavy admin.

Key strengths

✅ Customizable checklists/forms; quick issue capture with photos, pins, QR/NFC.

✅ Works offline; easy plan/document markup and BIM model viewing.

✅ Automated PDF/Excel reporting and auditable trails out of the box.

✅ Free external collaborator access and open API/connector options.

✅ Attractive time‑to‑value across many concurrent projects.

Potential drawbacks

❌ Advanced templates and reports benefit from upfront configuration.

Ideal for: This general contractor software is best for small to mid-size businesses prioritizing rapid field standardization for QA/QC, safety, punch, and handover documentation with minimal rollout effort.

Ready to streamline your workflows on site and in the office? Book a demo or compare prices to find the right plan for your team.

Procore

Full‑suite platform covering preconstruction through closeout with mature cost and contract controls plus the broadest construction app marketplace.

Key strengths

✅ Deep project controls: RFIs, Submittals, Change Events, Contracts & Cost.

✅ Extensive integrations (ERP/accounting, BI, storage, scheduling) and APIs.

✅ Strong field execution: inspections, observations, daily logs, mobile offline.

✅ Robust permissioning, templates, and standardized workflows for scale.

✅ Mature reporting with configurable dashboards and scheduled outputs.

Potential drawbacks

❌ Higher total cost and heavier implementation for multi‑division rollouts.

❌ Admin complexity for fine‑grained governance if under‑resourced.

❌ Some specialty capabilities rely on third‑party add‑ons.

Ideal for: Mid‑to‑large GCs running complex programs who need enterprise governance, rich integrations, and standardized controls across many projects.

Autodesk Build (Autodesk Construction Cloud)

Project and field management tightly connected to Autodesk Docs and models, aligning design and construction data in one environment.

Key strengths

✅ BIM‑native document control: sheets/models, markups, issues, compare.

✅ Solid RFIs/Submittals/Meetings with traceability to drawings/models.

✅ Cost Management module for change control and budgets.

✅ Good quality/safety forms and issues; mobile field execution.

✅ Works seamlessly with teams already standardized on Autodesk.

Potential drawbacks

❌ Best fit when the rest of the toolchain is Autodesk‑centric.

❌ Admin/config requires care; change management can be non‑trivial.

❌ Pricing can rise with ACC bundles and storage requirements.

Ideal for: GCs with strong VDC/BIM workflows collaborating closely with Autodesk‑based designers and owners wanting model‑to‑field continuity.

Fieldwire by Hilti

Lightweight, jobsite‑first tasking, punch lists, plan viewing, and simple forms designed for fast crew adoption. Good for small–mid GCs who want a pragmatic field tool over a full suite.

Key strengths

✅ Quick rollout; intuitive task and punch workflows.

✅ Offline‑friendly mobile; efficient photo handling; plan versioning.

✅ Good value for SMB–mid‑market; straightforward reporting.

Potential drawbacks

❌ Limited native cost/contract and enterprise governance features.

❌ Custom reporting/automation less extensive than larger suites.

Ideal for: Crews that need a pragmatic field tool for punch, checklists, and daily coordination without the overhead of an enterprise platform.

4. Decision Path: Which Software Fits Your GC Profile?

Choosing construction software is easier when you match your company profile to the strengths of each platform. Use the paths below to identify which tools align with your project size, field needs, budget expectations, and internal capacity for implementation.

If you are a small GC (5-25 field staff) needing a simple, mobile-first app:

-

PlanRadar — best fit for rapid inspections, punch, QA/QC, safety, and site reporting; low admin effort; strong mobile app adoption.

-

Fieldwire — good for lightweight tasking and punch workflows on smaller projects.

If you manage many concurrent small or mid-sized projects and need fast standardization:

-

PlanRadar — fast deployment across multiple sites; flexible checklists and reporting; minimal configuration burden.

-

Procore (select modules) — works if you need scalable governance, but requires more admin capacity.

If you are a mid-sized GC wanting stronger commercial controls:

-

Procore — best option for deep project controls (RFIs, submittals, change events, contracts, cost).

-

Autodesk Build — strong when cost management ties into model/drawing workflows.

If you are heavily invested in Autodesk workflows or run VDC/BIM-driven projects:

-

Autodesk Build — ideal model-to-field continuity, issue tracking directly on sheets/models, and native ACC integration.

If budget and licensing flexibility are top priorities:

-

PlanRadar — predictable per-user costs plus unlimited subcontractors reduce total cost for small teams.

-

Fieldwire — generally lower cost than full PM suites.

If your field crews are not tech-heavy or you need adoption within days:

-

PlanRadar — intuitive mobile interface, offline-first, suited to mixed-experience field teams.

-

Fieldwire — fast for basic tasking/punch.

If you need a broad ecosystem of ERP, scheduling, or BI integrations:

-

Procore — strongest marketplace, rich APIs, and deep partner integrations.

-

Autodesk Build — strong integrations within ACC and design workflows.

5. Pilot Plan (6-8 Weeks)

Purpose: Prove a platform’s value on a live project under real conditions. Over 6–8 weeks, deploy to a small cross‑functional team, load representative data, measure baseline→target KPIs, and validate integrations and change readiness.

Outcome: evidence‑based go/no‑go, rollout design, and TCO.

👷♀️ Team & roles

- PM (project controls), Superintendent (field), Foreman/Trade Lead, Safety, Accounting/ERP liaison, BIM/VDC lead (if applicable), and a Pilot Admin.

- Define responsibilities and success criteria per role.

📃 Data & templates

- Import: full spec set, drawings with versioning, RFIs, submittals.

- Configure: inspection checklists (QA/QC, safety, pre‑pour), punch template, daily log, weekly owner report and deficiency log templates.

- Establish permissions, numbering schemes, and naming standards.

⭐ KPIs & measurement

- Select 6–8 measurable KPIs; capture a baseline in week 0 and track weekly.

- Example targets: RFI cycle time ↓30%, Submittal cycle time ↓25%, Inspection time per checklist ↓35%, Punch close‑out ↓30%, Report prep time ↓70%, Daily‑log on‑time rate ≥95%, Time‑to‑first‑value ≤14 days.

- Define measurement method and data source (system dashboards, CSV exports). Set a weekly review cadence.

📣 Change management

- Name champions per role; schedule two focused trainings (field + office).

- Provide quick‑reference guides; hold weekly office hours.

- Track adoption metrics (active users, forms submitted, punch items closed).

🧐 Risks & controls

- Back‑out plan; offline coverage test for remote sites; storage/performance checks for photos/videos.

- Permissioning audit; ensure two trained admins for continuity.

✅ Decision & exit (week 6–8)

- Run export tests (docs, RFIs, submittals, issues, models, reports).

- Finalize governance and admin model; compile KPI deltas and lessons learned.

- Present TCO and license mix; record a Go/No‑Go decision with a phased rollout plan.

📆 Suggested timeline

- Week 0–1: Setup, data import, training.

- Week 2–4: Daily use, KPI tracking, feedback loops.

- Week 5: Integration validation & security checks.

- Week 6–8: Results, decision, rollout plan.

6. FAQ: General Contractor Software for Small & Mid-Size GCs

What is the best software for managing a construction site?

Small and mid-size GCs normally evaluate a mix of field execution and structured project controls. PlanRadar fits small and mid-size firms prioritizing fast field standardization and lower administrative overhead. Procore is widely used for RFIs, submittals, cost, and contracts, while Autodesk Build is preferred in BIM/VDC-heavy environments.

I run a small-mid-sized GC firm and need a simple site app for tracking work and issues.

For small and mid-size firms, PlanRadar provides a balance of ease of use and standardizable workflows across multiple jobs. Fieldwire works for lighter field coordination, while larger suites require more configuration before field crews can use them effectively.

What are the affordable software options to avoid enterprise pricing?

Small and mid-size GCs aiming to stay out of enterprise tiers typically look at PlanRadar or Fieldwire, since both support multi-project workflows without high admin overhead. Cost is largely driven by user count and needed integrations, making them more predictable than full PM or ERP-connected platforms.

What software is strongest for integrations with site tools?

For deep integrations—ERP, accounting, scheduling, storage, and BI—contractors most often evaluate Procore and Autodesk Build, both of which offer mature APIs and broad partner ecosystems. PlanRadar provides connectors and an open API suited to lighter integration needs, especially when workflows center on QA/QC, punch, safety, and field execution.

Which construction-management platforms are known for strong security and compliance?

Enterprise-level governance and compliance features are strongest in Procore and Autodesk Build, both of which support advanced permissioning, audit trails, SSO, and enterprise integrations. PlanRadar offers strict data security standards and controlled access for internal and external collaborators, but with a lighter administrative footprint suited to small–mid-sized teams.